The last two are the same regardless of whether its your first time or your 10th. Depending on the type of loan and amount a minimum down payment can range from 3 to 20 of the home purchase price.

How Long Between Exchange And Completion Homeowners Hub Conveyancing

A 5 down payment lowers your fee to 165 and a 10 down payment lowers your fee to 14.

. If your goal paying down a mortgage interest-only loans are a bad place to start. Before we dive in its worth pausing to note that the best source of funds for a down payment was is and always will be cash from your savings. When you borrow a down payment from someone else you leave yourself vulnerable to overleverage to slimmer cash flow margins and returns and to possible rate hikes or called loans.

If its a refinance from a different type of loan into a VA loan the funding fee is 23 if its your first use and 36 for a subsequent use. Buying mortgage leads is a great way to grow your mortgage business but Im a big believer in understanding how the sausage is made how these leads are generated. Mortgage brokers and mortgage lenders.

During the time while borrowers are able to draw down funds they usually must pay a. I also think that your lead buying will be more effective if you have considered and implemented many of the previous 49 mortgage marketing ideas. But for the first five to 10 years of the loan the homeowners equity doesnt grow at all unless the owner decides to make extra payments.

In exchange for borrowing the money and receiving these payments the borrower grants a lien interest in the 1. Investors poured 178 billion into private US. A down payment is the money youll pay up front towards the cost of your new home.

Interest-only mortgages today generally require large down payments so lenders have collateral against default. Mortgage rates hit highest point in 22 months The rate on the 30-year fixed mortgage increased to 345 from 322 last week according to Freddie Mac. Its paid on or before closing and reduces the amount of money youll need to borrow to purchase the home.

Decumulation is the phase of life when retirees must manage drawing down their nest egg and try to avoid running out of money. Before using the Procedures examiners should complete.

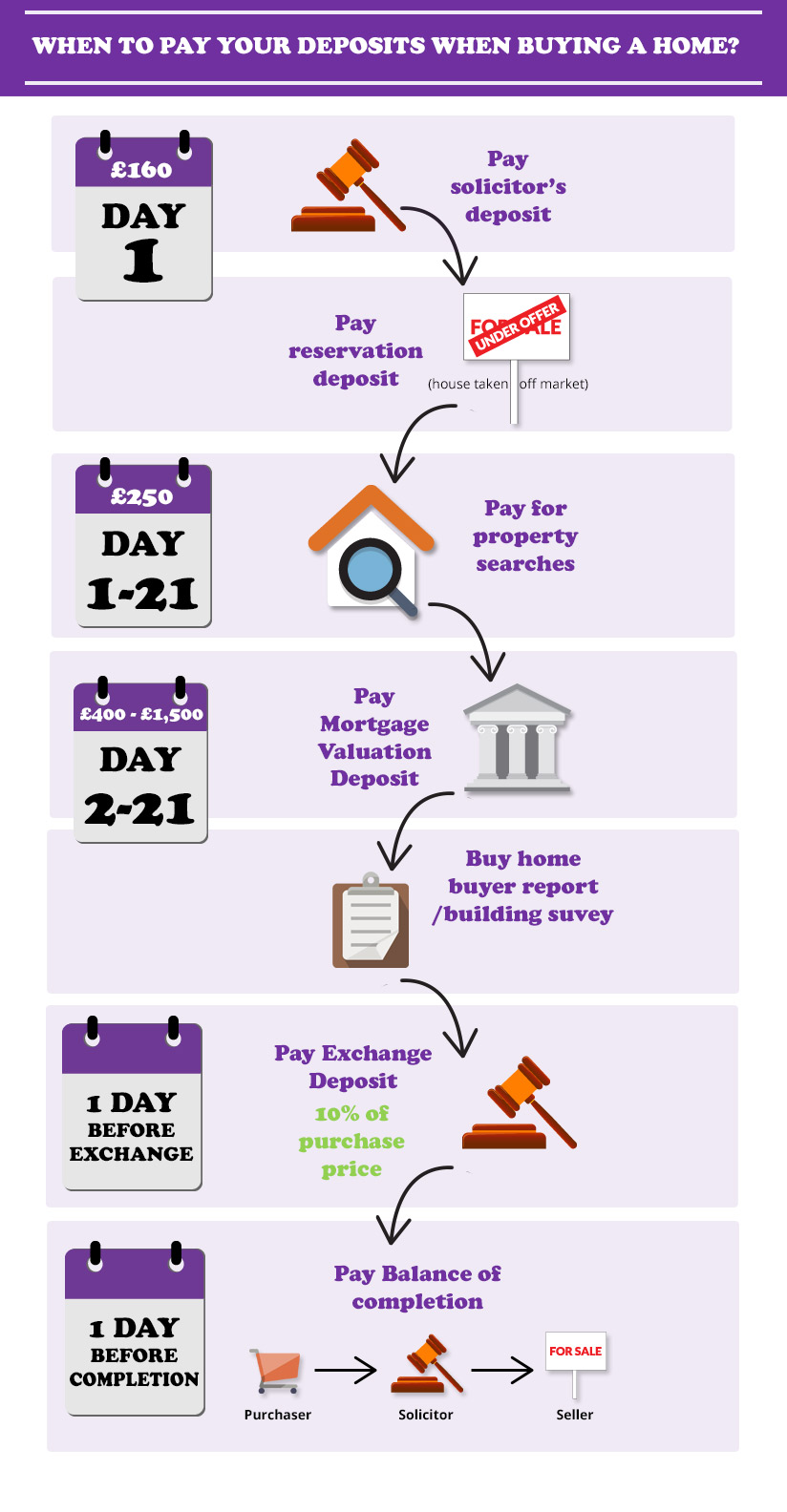

When Do You Pay Your House Deposit Sam Conveyancing

Exchange Contract Completion Explained 2022 Update Theadvisory

Process Of The Sale Of A House From A Buyer S Perspective Peter O Connor Son Solicitors Llp

Process Of The Sale Of A House From A Buyer S Perspective Peter O Connor Son Solicitors Llp

![]()

Can Solicitor Request Mortgage Funds Before Exchange Moneysavingexpert Forum

0 comments

Post a Comment